alaska sales tax on services

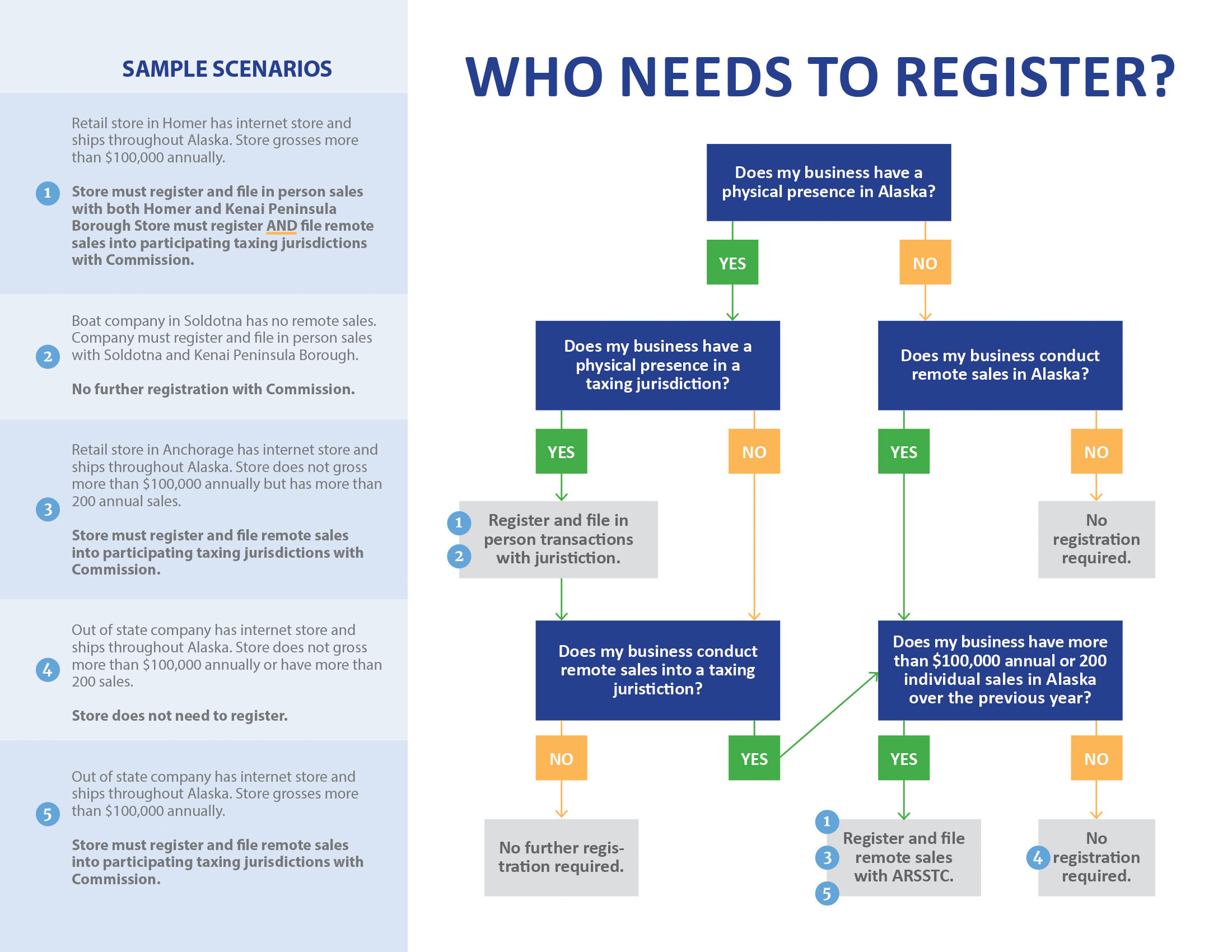

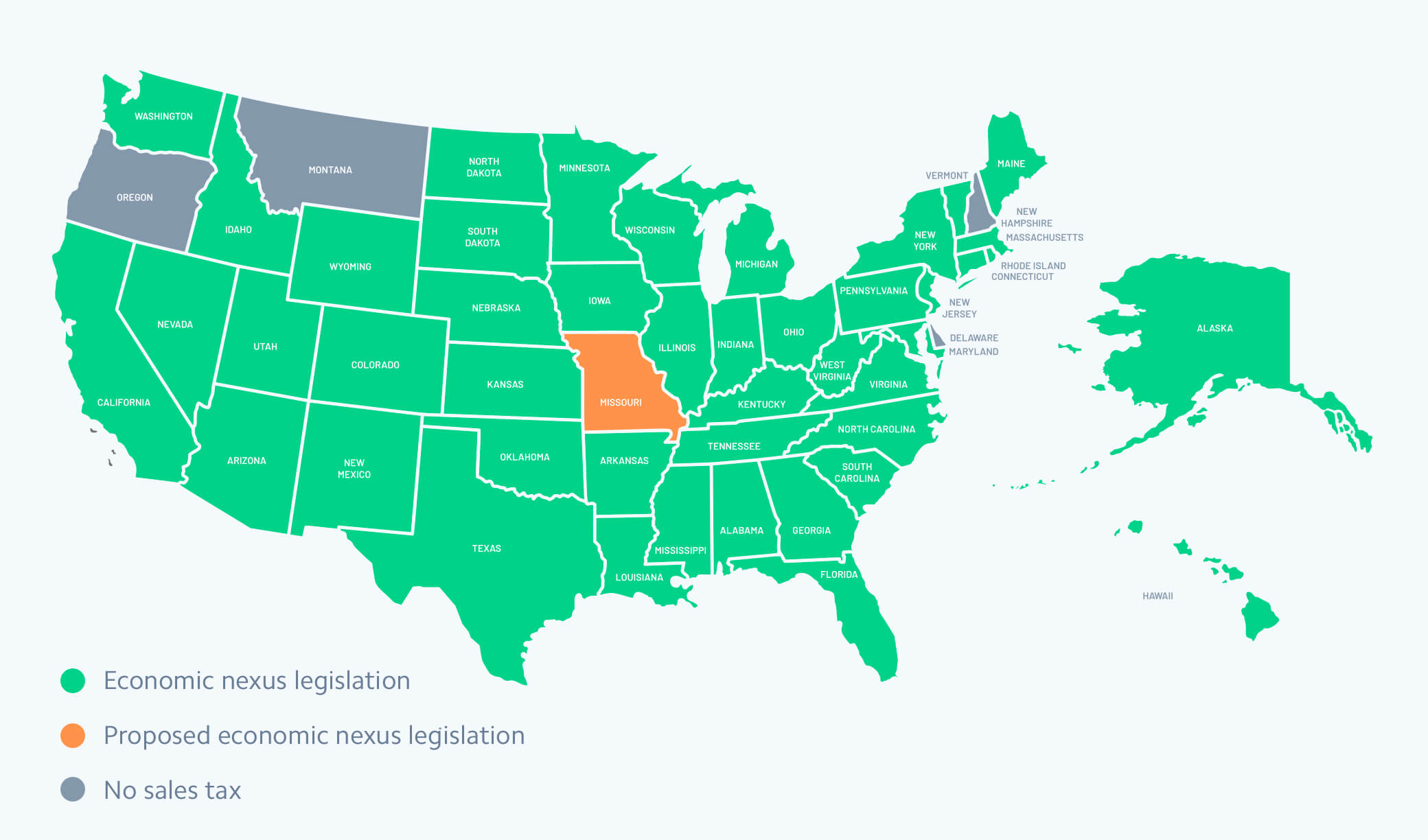

In reaction to the 2018 South Dakota. There are additional levels of sales tax at local jurisdictions too.

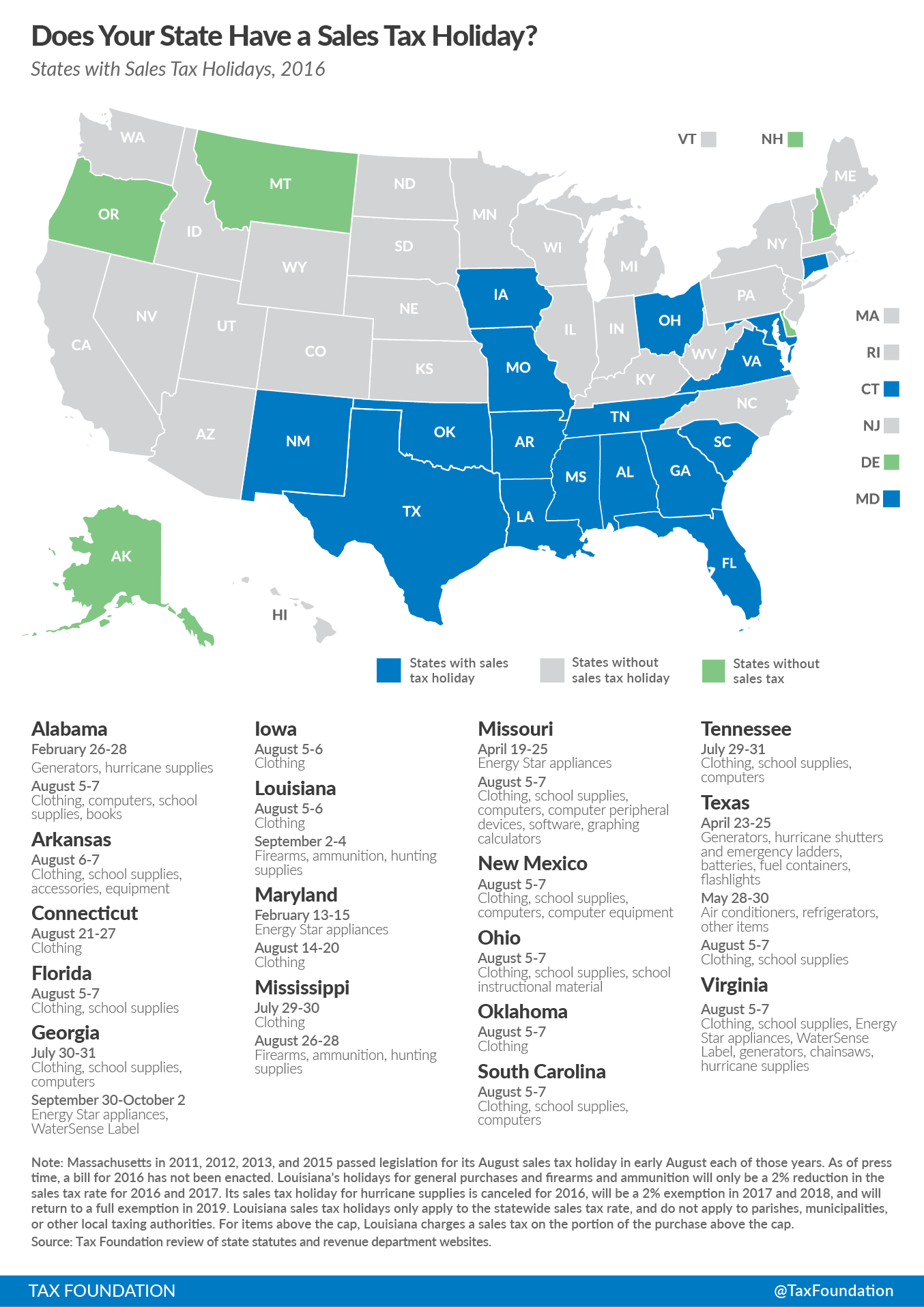

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Ad Lookup AK Sales Tax Rates By Zip.

. Alaska Jet Fuel Tax. Articles IX and X of the Alaska Constitution and Title 29 of the Alaska Statutes establish the legal framework for municipal taxation in Alaska. Welcome to the Alaska Sales Tax Lookup.

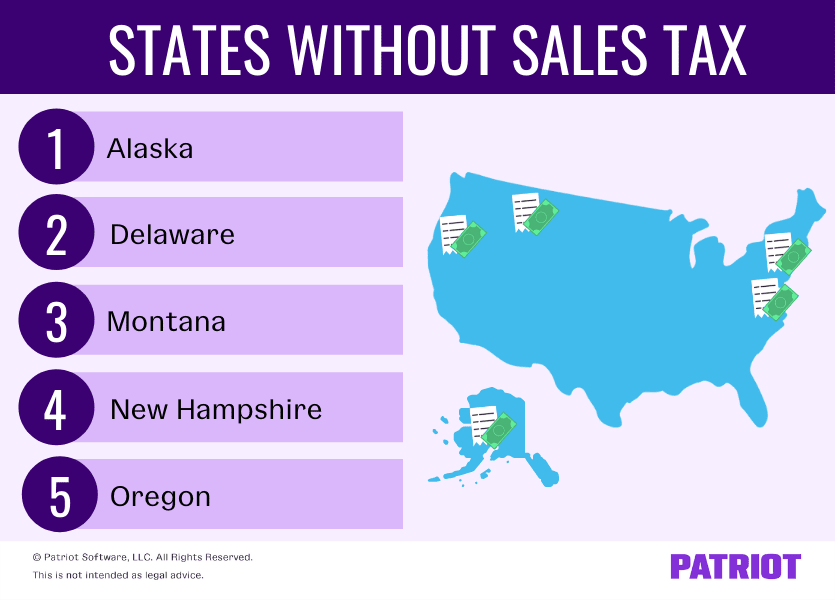

States New Hampshire Oregon Montana Alaska and Delaware do not impose any. The State of Alaska does not levy a sales tax. The Alaska state sales tax rate is 0 and the average AK sales tax after local surtaxes is 176.

The state-wide sales tax in Alaska is 0. The state capital Juneau has a 5 percent sales tax rate. Juneau Alaska KINY - Starting September 19 the City and Borough of Juneaus Cash Office and Sales Tax.

It is better to check with the Alaska Department of Revenue on the specific. At present the State of Alaska does not levy a sales tax. There are few exceptions to the application of sales tax and it is the.

31 rows The state sales tax rate in Alaska is 0000. The current statewide sales tax rate in Alaska AK is 0. Ad Based On Circumstances You May Already Qualify For Tax Relief.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Alaska - Tax Division. Thursday September 1st 2022 805am.

Exact tax amount may vary for different items. Individual towns have broad discretion over tax rates and sales taxes can be as high as 75 percent. There are however several municipal governments that do.

Alaska Aviation Fuel Tax. This guide is designed to provide an overview of the complexity of sales tax on services by state. There are however several municipal governments that do.

Therefore if you are a business entity subject to sales taxes within the state you will. The City of Adak levies a sales and use tax of on all sales rents and services made in the city at the rate of 4. The fuel vendors pay the taxes though the.

With local taxes the total sales tax rate is between 0000 and 9500. Alaska Remote Seller Sales Tax Commission - opens in new window or tab. 32 cents per gallon.

Alaska has a destination-based sales tax system so you have to pay. Alaska does not impose a state level sales tax however eBay is required to collect sales taxes in certain Alaska. The City of Wasilla collects a 25 sales tax on all sales services and rentals within the City unless exempt by WMC 516050 see the Sales Tax Exemption page for information about.

Free Case Review Begin Online. A portion of the Alaska tax law. This lookup tool is provided by the Alaska Remote Seller Sales Tax Commission ARSSTC.

1 day agoMore from News of the North. Statewide sales tax rate Economic Sales Threshold. The State of Alaska taxes Services Tangible Products Digital Products and Software-as-a-Service products.

9 cents per gallon. The state constitution and other. Register with Munirevs with Alaska.

Local taxing authoritieslike cities and. 47 cents per gallon. Ad New State Sales Tax Registration.

Ad 5 Best Tax Relief Companies of 2022. State Substitute Form W-9 - Requesting Taxpayer ID Info. 47 cents per gallon.

State of Alaska Department of Revenue For corrections or if any link or information is inaccurate or otherwise out-dated please email The Webmaster. This can be accomplished by either enrolling in our Done-for-You Sales Tax Service or by completing the necessary forms on the. 2022 Alaska state sales tax.

End Your Tax Nightmare Now. And travel services for State government. 32 cents per gallon.

The two largest cities Anchorage and Fairbanks do not charge a local sales tax. District of Columbia State of Alaska Sales Tax Exemption PDF Tax Information. Free Unlimited Searches Try Now.

With local taxes the total sales tax rate is. See If You Qualify For IRS Fresh Start Program. Sales Tax Alaska information registration support.

Alaska Sales Tax Guide And Calculator 2022 Taxjar

States Without Sales Tax Article

Amazon Tax Vs Existing State Use Taxes American History Timeline Accounting Services Tax

Sales Tax Ideas Salestax Small Business Tax Business Tax Tax Write Offs

Alaska State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Sales Tax By State Is Saas Taxable Taxjar

Why Hb 1628 S Sales Tax On Services Is Bad For Maryland Maryland Association Of Cpas Macpa

Sales Allocation Methods The Cpa Journal Method Journal Cpa

U S States With No Sales Tax Taxjar

Do I Have To Charge Sales Tax Sales Tax Laws Nexus More

The Geography Of Taxation Tips Forrent Infographic Study Fun Geography

Introduction To Us Sales Tax And Economic Nexus

State Corporate Income Tax Rates And Brackets Tax Foundation

Where Amazon Collects Sales Tax Map Excel Grid

.png)

States Sales Taxes On Software Tax Foundation

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax District Of Columbia

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation