nebraska sales tax calculator

Maximum Possible Sales Tax. Wood River is located within Hall County Nebraska.

Form 10 Fillable Nebraska And Local Sales And Use Tax Return With Schedule I Mvl And Instructions 10 2011

The state sales tax rate in Nebraska is 5500.

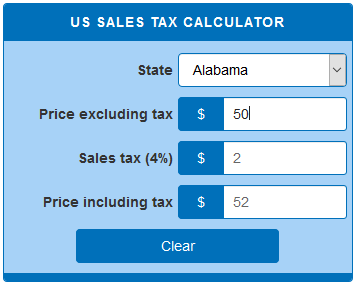

. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. To determine the income with which to calculate your tax bill in Nebraska you begin with your federal adjusted gross income AGI.

This includes the rates on the state county city and special levels. This includes the rates on the state county city and special levels. Omaha has parts of it located within Douglas County.

So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate. Sales Tax Rate Finder. Sales Tax Rate s c l sr.

The average cumulative sales tax rate in Omaha Nebraska is 686. Elkhorn is located within Douglas County. The base state sales tax rate in Nebraska is 55.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. This can be found on IRS Form 1040. The Dakota County Nebraska Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Dakota County Nebraska in the USA using average Sales Tax Rates.

With local taxes the total sales tax rate is between 5500. The average cumulative sales tax rate in Elkhorn Nebraska is 7. Maximum Local Sales Tax.

Request a Business Tax Payment Plan. Nebraska is a destination-based sales tax state. With local taxes the total sales tax rate is between 5500 and 8000.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. What is the income tax rate in Nebraska. Maximum Local Sales Tax.

Nebraska State Sales Tax. Find your Nebraska combined state. So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the.

Nebraska State Sales Tax. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Groceries are exempt from the Nebraska sales tax.

Average Local State Sales Tax. Sales and Use Tax. For example lets say that you want.

This includes the rates on the state county city and special levels. Make a Payment Only. This includes the rates on the state county city and special levels.

Counties and cities can charge an. The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725. The Nebraska NE state sales tax rate is currently 55.

How to Calculate Nebraska Sales Tax on a Car. The Nebraska state sales and use tax rate is 55 055. The average cumulative sales tax rate in Wood River Nebraska is 55.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 55 in Edgemont Nebraska. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37. Average Local State Sales Tax.

Maximum Possible Sales Tax. The Nebraska state sales and use tax rate is 55 055. All numbers are rounded in the normal fashion.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

Us Sales Tax Calculator Calculatorsworld Com

Sales Tax Calculator And Rate Lookup Tool Avalara

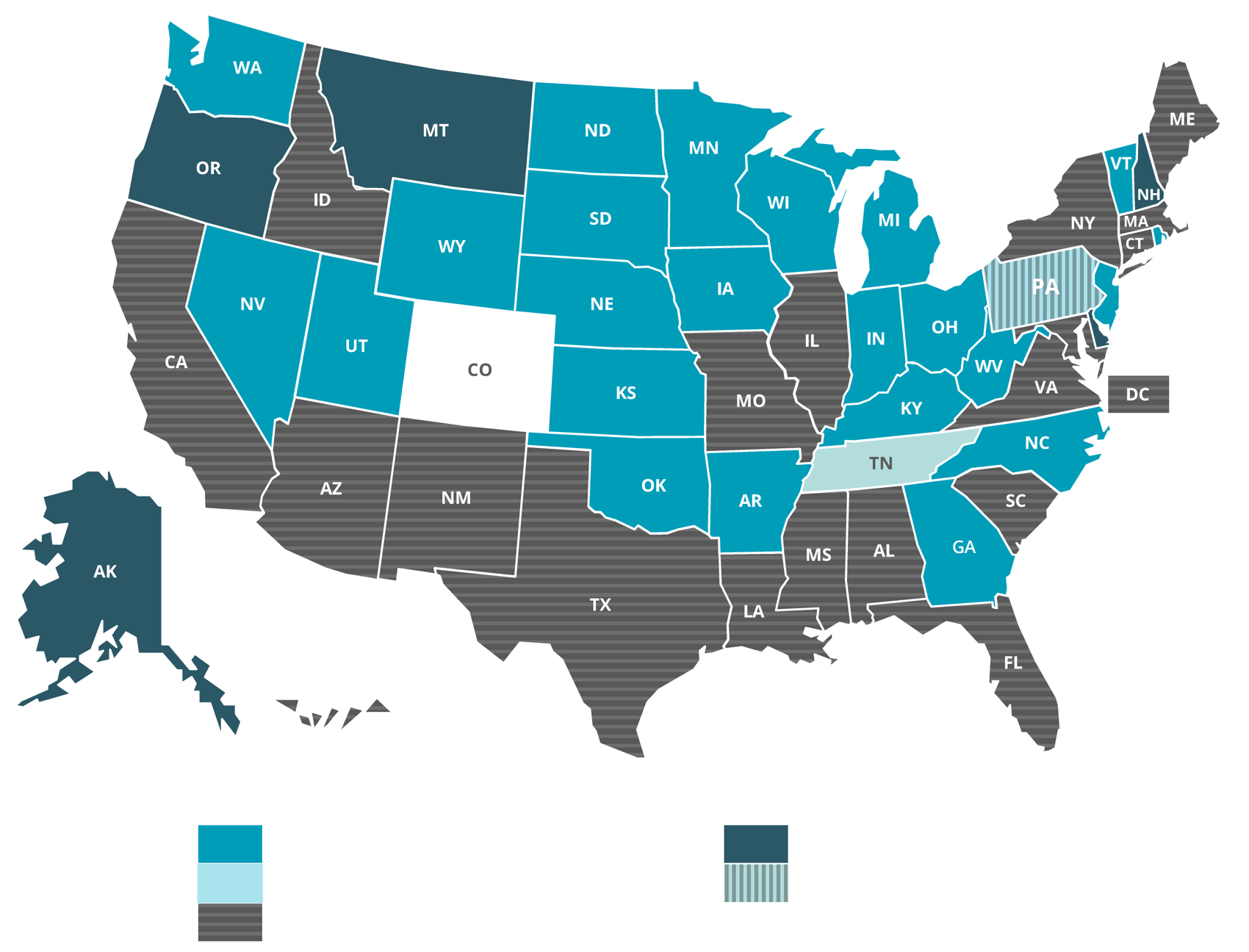

State Tax Levels In The United States Wikipedia

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Sales Tax For Nonprofit Organizations In Nebraska Ingrid Kirst Consulting

Sales Tax Calculator Find Rates In Your Area Now Quickbooks

Nebraska Income Tax Ne State Tax Calculator Community Tax

Amazon Sales Tax Everything You Need To Know Sellbrite

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

98104 Sales Tax Rate Wa Sales Taxes By Zip October 2022

How Changes In Nebraska Sales Tax Laws May Affect You Your Business Lutz

11 9 Sales Tax Calculator Template

The 10 Least Tax Friendly States For Middle Class Families Kiplinger